InsurerLink

The secure, centralized intelligence hub for the global motor insurance industry. Enabling real-time cross-insurer verification and AI-driven fraud prevention.

See InsurerLink in Action

Discover how InsurerLink transforms motor claims intelligence across the national insurance ecosystem.

Reduce Fraud & Leakage

AI-driven detection and real-time verification to eliminate duplicate claims and staged incidents.

Increase Speed & Accuracy

Standardized workflows and instant data access to accelerate claims processing and decision making.

Strengthen Market Stability

Building industry trust through shared intelligence and protecting the financial strength of the market.

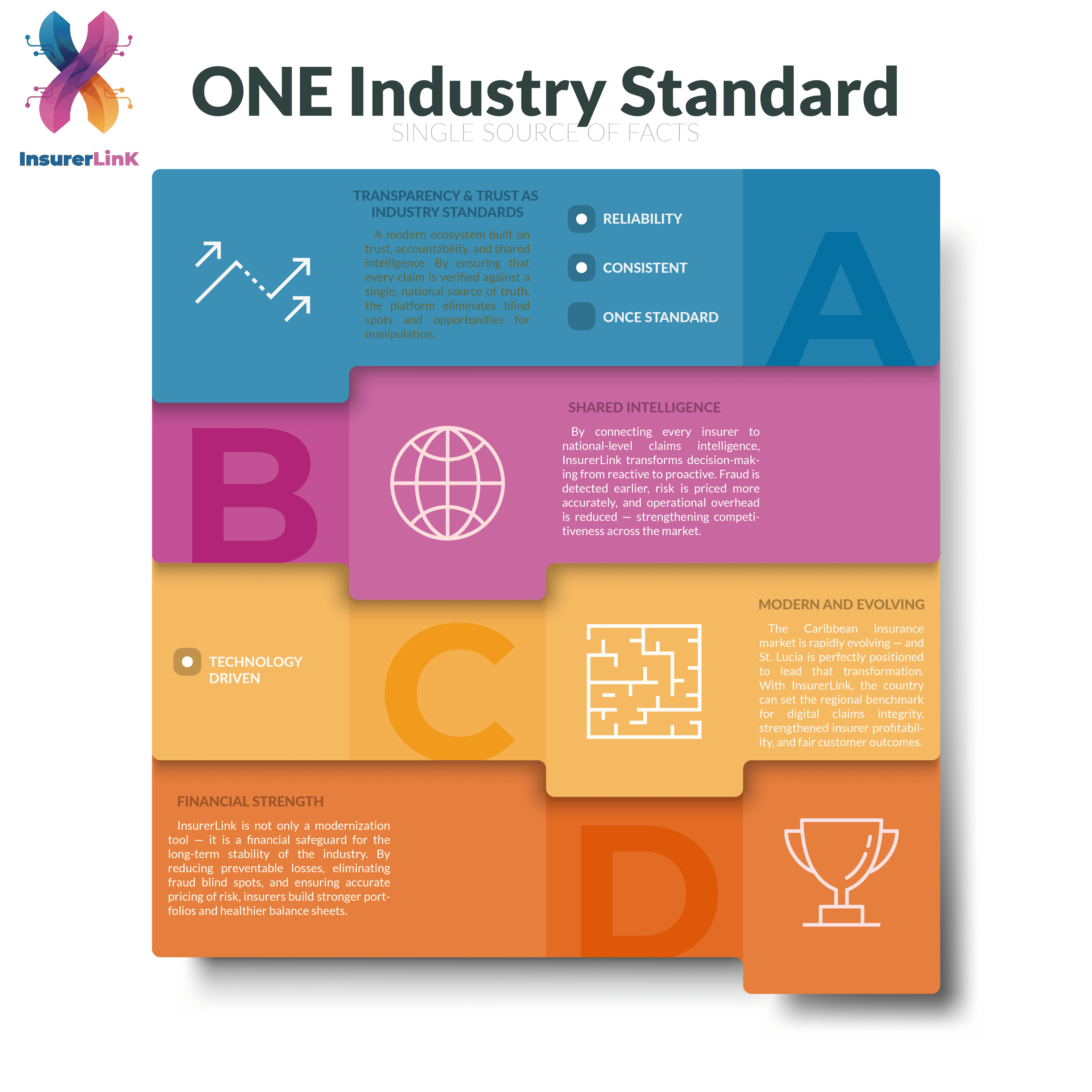

One Industry, One Source of Truth

InsurerLink consolidates fragmented data into a single national intelligence hub. By sharing claims data securely across the ecosystem, we eliminate blind spots and empower every insurer with actionable insights.

- Real-time cross-insurer verification

- Prevention of duplicate claims across companies

- Standardized claims workflows and data formats

- Market-wide analytics for strategic decision making

A Clearer View of the National Market

Gain unprecedented insights into claims trends across markets. Our centralized platform transforms raw data into strategic intelligence, helping you identify hotspots and emerging patterns in real-time.

Built for Enterprise Resilience

A comprehensive suite of tools designed to modernize insurance infrastructure globally.

AI-Driven Fraud Detection

Automated red-flagging of repeat offenders and suspicious claim patterns across the national database.

Instant Claims Lookup

Real-time verification of driver, vehicle, and policy history to prevent duplicate filings.

National Analytics Dashboard

Comprehensive visibility into industry trends, hotspots, and claims benchmarking for better oversight.

Screening & Compliance

Integrated Sanctions, Watchlist, and PEP screening to meet rigorous regulatory requirements.

Secure Document Exchange

Encrypted inter-company communication to eliminate insecure manual channels like email or WhatsApp.

Governance & RBAC

Granular role-based access control and full auditability governed by Regulatory Bodies for each region.

Elevating National Insurance Intelligence Together

Discuss how InsurerLink will transform motor claims verification and fraud prevention for your organization and insurance markets worldwide.